Categories

Buying a Home in the DC Metro Area, DMV Real Estate News, Financial Planning, First-Time Homebuyer Resources, Homebuying Tips, Home Buying Tips, Homeownership Tips, Maryland Homeownership, Mortgage Education, Mortgage & Loan Education, Real Estate, Real Estate Insights, Real Estate Market Trends 2025, Washington, DC Real EstatePublished November 24, 2025

50-Year Mortgage vs 30-Year Mortgage: What Homebuyers in DC, MD & VA Need to Know

50-Year Mortgage vs 30-Year Mortgage: What Homebuyers in DC, MD & VA Need to Know

With home prices continuing to climb across Washington DC, Maryland, and Northern Virginia, some homebuyers are exploring every option to make homeownership more affordable. One emerging option gaining attention is the 50-year mortgage, a significant departure from the traditional 30-year loan that has dominated the DMV housing market for decades.

Key Takeaways

• Monthly payments: A 50-year mortgage can reduce monthly payments by $250-$400 compared to a 30-year loan on the same home

• Total interest: You'll pay roughly 70% more in total interest over the life of a 50-year loan, often exceeding the home's original purchase price

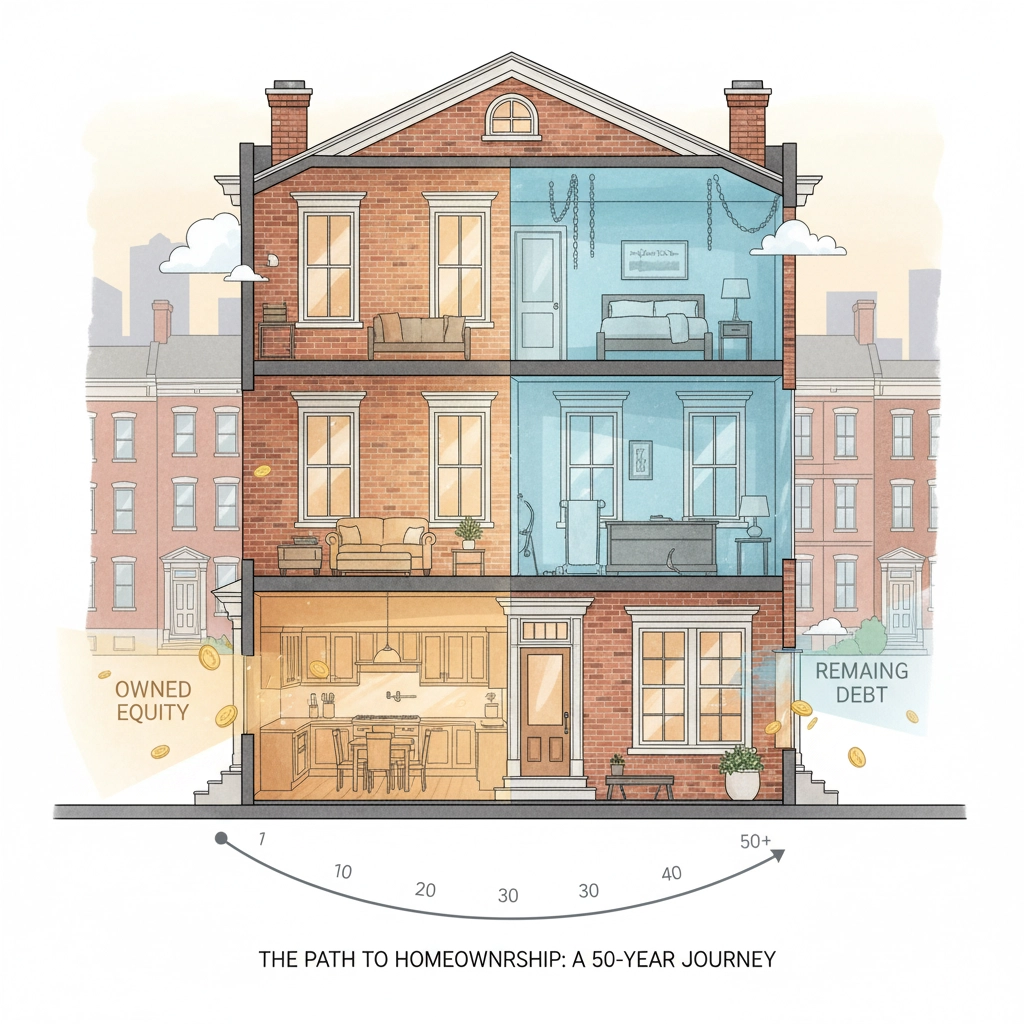

• Equity building: Equity accumulation is dramatically slower, potentially keeping you financially tied to the property for decades longer

• DMV market fit: Limited availability and higher interest rates make this option less practical for most buyers in our competitive local market

• Best candidates: First-time buyers currently priced out of Washington DC homes for sale or those needing temporary payment relief

How Monthly Payments Compare

The primary appeal of a 50-year mortgage is straightforward: lower monthly payments. Let's break down the numbers using typical home prices we see across the DMV.

On a $400,000 home (closer to the median for Maryland homes for sale) with a 6.5% interest rate:

- 30-year mortgage: Approximately $2,528 per month

- 50-year mortgage: Around $2,200 per month

- Monthly savings: $328

For a $500,000 home (common in Northern Virginia homes for sale) at 6.5%:

- 30-year mortgage: Approximately $3,160 per month

- 50-year mortgage: Around $2,750 per month

- Monthly savings: $410

These savings can make the difference between qualifying and not qualifying for a loan, especially important when buying a house in Washington DC where income requirements are steep.

However, there's a critical caveat: these calculations assume identical interest rates. In reality, lenders typically charge higher rates for 50-year mortgages due to increased risk, which reduces your actual monthly savings.

The True Cost of Extended Terms

While lower monthly payments sound attractive, the long-term financial impact tells a different story. The total interest paid over 50 years can be staggering.

Using our $400,000 home example:

- 30-year total interest: Approximately $510,000

- 50-year total interest: Around $770,000

- Additional cost: $260,000 more in interest

For the $500,000 home:

- 30-year total interest: Approximately $638,000

- 50-year total interest: Around $962,000

- Additional cost: $324,000 more in interest

This means on a 50-year mortgage, you could pay nearly twice the home's original purchase price just in interest, a significant consideration given our region's already high housing costs.

Equity Building: The Hidden Challenge

One of the most overlooked aspects of 50-year mortgages is how they impact equity building. In the DMV market, where home values have historically appreciated well, building equity is often a key wealth-building strategy.

With a traditional 30-year mortgage, after 10 years you typically own about 16% of your home's value through principal payments alone (not counting appreciation). With a 50-year mortgage, equity builds much more slowly in the early decades.

This slower equity accumulation has several implications:

- Refinancing challenges: Less equity makes it harder to refinance without PMI

- Moving flexibility: Selling becomes more complex when you owe more than the home's worth

- Wealth building delays: Home equity often serves as a foundation for other investments or major purchases

DMV Market Realities

The current DC real estate market update shows unique challenges that make 50-year mortgages particularly complex in our region.

Limited availability: Most lenders in the DMV don't currently offer 50-year mortgages, making this option theoretical for many buyers.

Competitive market dynamics: In areas like Arlington, Bethesda, or Georgetown, where multiple offers are common, financing terms can impact your offer's attractiveness. A 50-year mortgage might signal financial strain to sellers.

Property tax implications: DC, Maryland, and Virginia all have significant property taxes that continue for the loan's entire term. Over 50 years, property tax payments alone could equal or exceed the original mortgage amount.

Condo and HOA fees: Many DMV homes come with condo or HOA fees. These fees typically increase over time and represent an additional 50 years of payments that can add hundreds of thousands to your total housing costs.

Who Might Benefit

Despite the drawbacks, 50-year mortgages could help specific types of DMV buyers:

First-time buyers priced out of the market: If you're currently unable to qualify for any home loan, a 50-year mortgage might provide a path to homeownership while you work on increasing your income.

Young professionals with growing incomes: If you're early in your career with strong income growth potential, you could make extra principal payments early to offset some of the extended term's costs.

Those planning strategic refinancing: Some buyers might use a 50-year mortgage temporarily, then refinance to a shorter term when their financial situation improves.

Better Alternatives to Consider

Before committing to 50 years of payments, consider these DMV-specific alternatives:

Expand your search area: Northern Virginia and Maryland often offer better value than DC proper. The Metro system makes many suburbs highly accessible.

Consider different property types: Condos and townhomes typically cost less than single-family homes and can provide a stepping stone to your ideal home.

First-time buyer programs: DC, Maryland, and Virginia all offer down payment assistance and favorable loan terms for qualified first-time buyers.

Improve your financial profile: Sometimes waiting 6-12 months while paying down debt or saving more can unlock better loan terms than stretching to 50 years.

Making the Decision

If you're considering a 50-year mortgage in the DMV, ask yourself:

- Can I afford the home with a traditional 30-year mortgage if I expand my search area or adjust my criteria?

- Am I choosing this option out of necessity or convenience?

- What's my realistic income trajectory over the next 5-10 years?

- How important is building equity versus minimizing monthly payments?

The answers will help determine whether this extended loan term serves your long-term financial interests.

Frequently Asked Questions

Q: Are 50-year mortgages widely available in DC, MD, and VA?

A: Currently, very few lenders in our region offer 50-year mortgages. Most discussions focus on potential future availability rather than current options.

Q: Can I pay extra principal on a 50-year mortgage to shorten the term?

A: Yes, but check for prepayment penalties. Making even small extra principal payments early in the loan can significantly reduce the total term and interest paid.

Q: How do 50-year mortgages affect my debt-to-income ratio for qualifying?

A: The lower monthly payment improves your debt-to-income ratio, potentially helping you qualify for a larger loan amount.

Q: What happens if I want to sell my home early with a 50-year mortgage?

A: You can sell anytime, but you'll likely owe more than with a 30-year mortgage due to slower principal reduction, especially in the early years.

Q: Do 50-year mortgages work with FHA or VA loans?

A: Currently, FHA and VA programs don't offer 50-year terms. This option would likely be limited to conventional loans if it becomes widely available.

Ready to explore your mortgage options in the DMV? Connect with our team for personalized guidance on financing strategies that fit your situation and goals.

Written by Mascotti & Company, a DMV real-estate team with Keller Williams Capital Properties.

Mascotti & Company provides equal professional services without regard to race, color, religion, sex (including gender identity and sexual orientation), disability, familial status, or national origin.